4 Critical Actions For Effective M&A Communications

If you’re managing a team through a potential merger or acquisition, you may not realize just how critical your role is in M&A communication. Your actions and words — or lack thereof — can mean the difference between a high-performing team and one that has already checked out.

Research on sustaining employee engagement during times of great change — like mergers — suggests that mid-level managers and supervisors are the fulcrum: the pivot point of support upon which teams rely. Forbes points to mid-level managers as one of the most important drivers of merger success, and data from Gallup concludes that managers are responsible for 70% of the variance in employee engagement.

In this article, we argue the critical business case for strategic communications before, during, and after your merger or acquisition, plus four strategies to adopt along the way.

Why an M&A Communication Plan Is Critical for Integration Success

A lot goes into an M&A deal — regardless of the size, structure, or transaction type — to ensure its success. But with so many complexities at play, it’s an unfortunate reality that creating a robust communications plan often falls by the wayside.

In our work advising clients through these deals, we often find that organizations have no dedicated resource for their communications strategy, which means that these responsibilities end up divided among several stakeholders. The risk here is evident: communications that feel fragmented, disconnected from your culture, or create more questions than they answer.

The goal of M&A communications is foremost to centralize and solidify how you plan to communicate this new chapter of your business. When you do this foundational work, the result is communications that bolster trust between leaders and employees, cascade information seamlessly across teams and functions, and begin to unify two organizations into one whole.

Anatomy of Effective M&A Communications

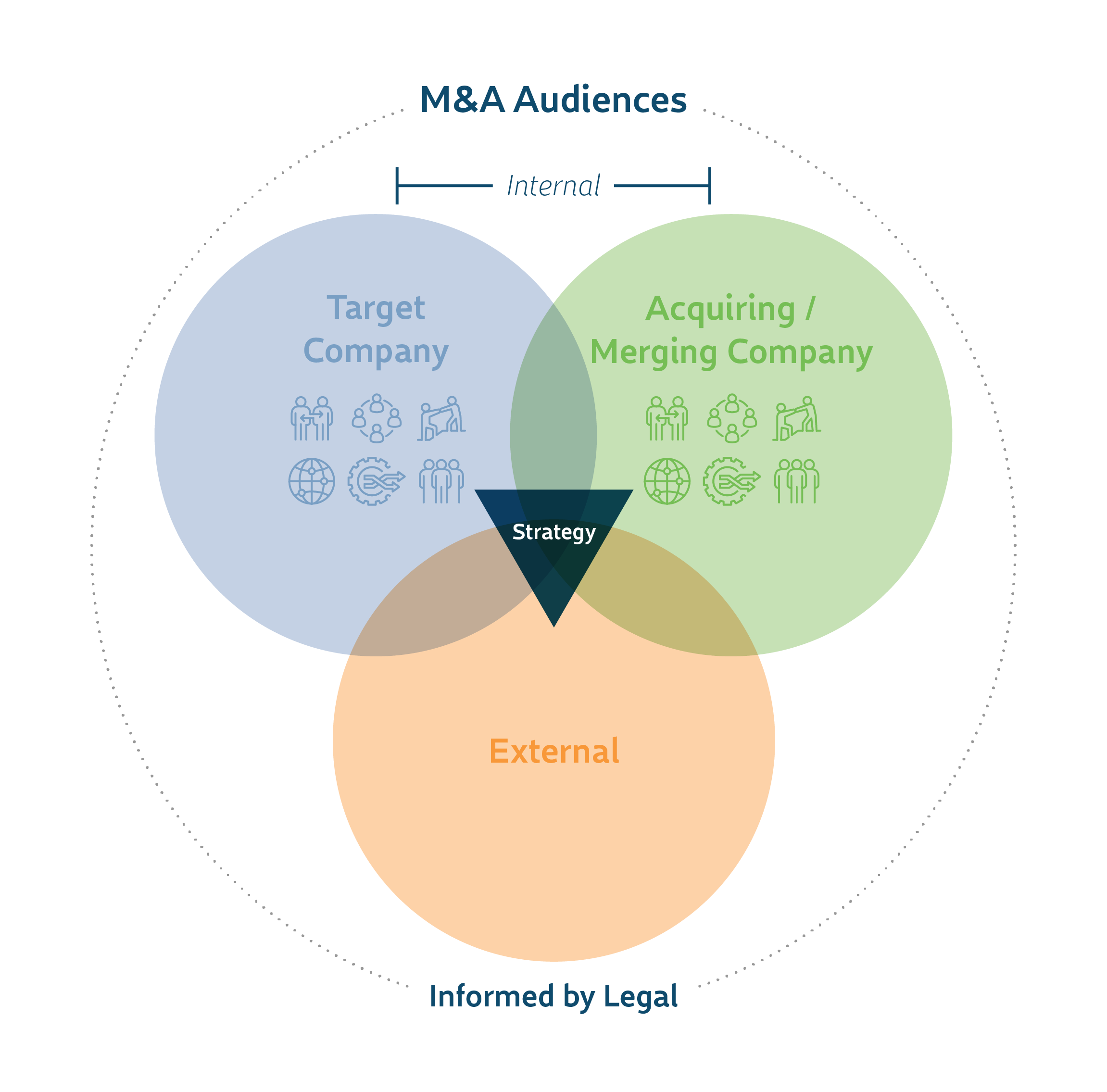

A well-rounded M&A communications strategy should concern itself with three primary audiences:

- External audiences, such as customers, vendors, partners, and the public, who will typically hear of the transaction through social media posts, press releases, or new outlets.

- The target company, including the individuals who are most directly affected by the deal.

- And the acquiring or merging company itself. These employees may also be directly affected by the transaction, though often to a lesser degree.

As our graphic above illustrates, each of these target audiences relates and connects to one another, but your communications should consider how to best position information for its intended audience. An official press release, for example, should look and feel much different than an email sent to the target company’s employees.

That said, even though your messaging should be tailored to specific audiences, it should always connect back to your core strategy, which is centered in your vision for the future and the “why” behind the transformation.

Why Your Communications Should Fit Your People (And Not the Other Way Around)

Just as no two mergers and acquisitions are the same, no two communications strategies should be the same. While best practices can and should guide your direction, communications that reach their intended audiences and lead to intended outcomes are those designed with a people-centered philosophy. We call this approach Human, Compelling, Visual Communications™.

Here’s how it looks in practice:

Be Human

During a merger or acquisition, it’s critical to focus on messaging built on our shared humanity and focused on fostering community and empathy. Put yourself in the shoes of your audiences, and lean on existing communications channels (where they exist) so that all parties are receiving communications in formats that feel familiar.

Part of making communications feel human is leaning into our innate abilities to spot connections and find patterns. The key is repetition: reiterating the most important details about the deal regularly and ensuring that it stems from the same source — be it a well-known leader of the organization or a dedicated section in your intranet. Establishing a regular cadence for your communications provides a sense of stability amidst the transformation, and it ensures people know where, when, and from whom they can expect updates.

Be Compelling

Moving beyond the initial transition and into action requires communications that elicit employee buy-in, cut through the noise, and illuminate the vision and purpose behind bringing the two organizations together — all of which you can address by answering these types of questions:

- Why are we doing this?

- Why is it happening now?

- What will it enable?

- What new opportunities, growth, and innovations does the deal offer to the people who work here?

- What will it enable for customers and stakeholders?

Be Visual

In our experience, how you share information is just as important as what you are sharing. Supporting your M&A story with visuals builds connection and alignment faster than words alone.

Our long-standing M&A work with a high-tech firm client is a great example of how communications that are human, visual, and compelling can engage, inspire, and unite teams. Our consultants recognized that the success of one deal, in particular — which involved a target company of around 40 people — would be contingent on retained employees feeling seen, valued, heard, and included.

Because talent retention was a key measurement of success, we took the time to develop a custom welcome book with individual photographs of each person on the cover. The end product was widely and warmly received by team members across the board.

4 Actions for M&A Communications Success

So how can you deliver effectively on such a weighty responsibility? M&A communication boils down to four critical actions:

1. Put On Your Own “Oxygen Mask” Before Assisting Others

Your team members will be looking to you for cues. Do you appear anxious or confident? Are you informed about the merger and what it means to you and your team? Are you distracted by the unknowns or focused on today’s priorities?

Your employees need to feel your strength through the ambiguity, so be sure you’re well-informed, calm, and prepared before trying to help your team.

2. Stay One Step Ahead

If there’s one effective weapon against fear, it’s information. Review and ensure you understand the company’s formal communications early and know your facts. Ask questions and know what questions to anticipate from your team. Identify and write down two or three core messages that you need your team to hear, and bridge back to those core messages repeatedly over time.

Hearing a consistent message helps ground people and keep them focused on more tangible, positive outcomes — like how the merger will help the company moving forward. Finally, step up the frequency of your team communications and favor in-person or on-the-phone conversations over email alone.

3. Create a Safe Environment

Keep your office door open as much as possible and welcome drop-ins from your team. Encourage them to ask questions and voice their concerns. You may not have all the answers, but it’s important to acknowledge the questions and concerns. Let them know when you don’t know — but pledge to try to get answers.

Every question presents an opportunity to bridge to one of your core messages. While you want to get as much clarity as possible, getting comfortable with ambiguity and modeling that comfort level with your teams is just as important. Don’t forget to share any trending concerns with your leadership to ensure they have a pulse on their employees’ sentiments.

4. Reach Out for Help

Your Corporate Communications or Human Resources team likely has some resources to support you with the above, such as company merger messaging, video messages from your leaders, slides, FAQs, training, etc.

Companies that understand the crucial role of managers in helping teams navigate change often develop M&A Tool Kits to facilitate the transition. If you haven’t seen resources like this, reach out to your Corporate Communications or HR leaders proactively.

Managers, don’t forget that you’re the fulcrum. You have the responsibility (and ability!) to provide the support that fuels your team’s engagement and productivity.

Bring Your Communications Strategy to Life

At Blue Beyond Consulting, we’ve supported countless Fortune 500 companies through their mergers, acquisitions, and other substantial transformations. See how our pressure-tested process works, or download our complete M&A communications playbook below to learn more.

Bring Your Communications Strategy to Life

At Blue Beyond Consulting, we’ve supported countless Fortune 500 companies through their mergers, acquisitions, and other substantial transformations. See how our pressure-tested process works, or download our complete M&A communications playbook below to learn more.